So you got into college!

Now it’s time to sift through your financial aid offers and make your decision! Before you accept any aid, it’s important to truly understand what the offer in front of you really means.

We’ll break down the entire process of figuring out your financial aid award letter:

- The Lingo

- What is a Financial Aid Award Letter?

- Understanding Your Financial Aid Award Letters

- How to Compare Aid Offers

- Is My Financial Aid Offer Good?

- How and When to Appeal a Financial Aid Award

- Accept Aid Intentionally

- Other Important Notes

- Final Thoughts

The Lingo

In this blog, we’ll primarily use the term Financial Aid Award Letter, but we want you to know that it can be called a variety of things, such as:

- Aid Letter

- Financial Aid Package or Aid Package

- Merit Letter

- Financial Aid Offer

- And probably a few more!

This is not to confuse you, but just to make you aware that your institution may use another term.

What is a Financial Aid Award Letter?

A Financial Aid Award Letter is an offer from an institution that contains all the federal, state, and school aid you can access. This can include scholarships, grants, work-study opportunities, and federal subsidized and unsubsidized loans. If you listed multiple schools on your FAFSA, you will receive financial aid award letters from each school you are accepted to.

When to Expect a Financial Aid Award Letter

The timeline of receiving financial aid award letters can vary. Typically, they arrive in March or April after you’ve received an acceptance from an institution. Some schools are more prompt than others, so make sure to be on the lookout for your award letters and keep track of who you’re still waiting on.

Understanding Your Financial Aid Award Letters

Before we can compare any financial aid award letters, we’ll want to understand what they all mean independently. Each institution will use a different format for their letters, but they will all contain roughly the same information.

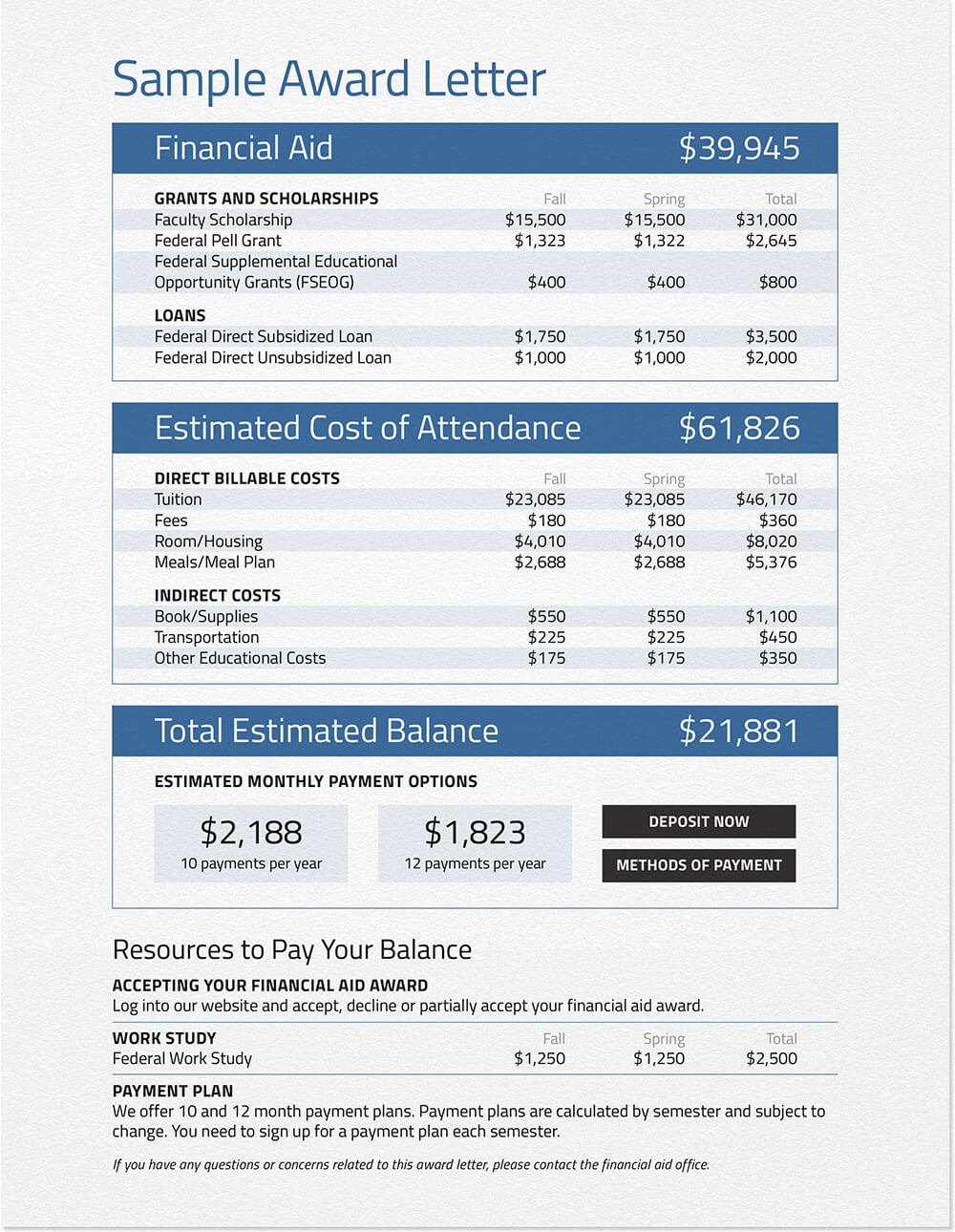

Let’s use an example from CollegeCovered as a frame of reference.

In this award letter, you will see three separate sections.

- Financial Aid

- Estimated Cost of Attendance*

- Total Estimated Balance

Financial Aid

This section shows both the scholarships and loans this student was awarded.

Estimated Cost of Attendance

This section shows the total estimated cost of attendance. This particular university broke this cost into two sections — the billable costs (ones that are concrete) and the indirect costs (what they estimate students will spend on other items).

Some of these costs you may not incur. For example, if you are choosing to live off campus, you would not incur the $8,020 per year housing cost. Oftentimes, universities will add campus health insurance to the estimated COA. But, many students choose to opt out of this and remain on a parent’s plan. Thus, the COA ends up lower. If there is a cost listed in the COA that you 100% will not incur, make adjustments where you see fit when examining the aid offer.

*Not all financial aid award letters will show the Cost of Attendance. This is often a category that gets left out. If this isn’t on your financial aid award letter, make sure to call the institution to verify the number or ask for a full breakdown before making any calculations or comparisons. Don’t rely completely on what is online as the information could be outdated.

Total Estimated Balance

This is the amount left over if you accepted all of the financial aid and incurred all of the costs listed in the COA. This is what the institution estimates that you would pay yearly.

Note that this estimated balance will likely not be 100% accurate for you unless you plan to accept all of the financial aid offered to you and incur all of the listed costs.

Figure Out the Net Price

Because the total estimated balance won’t always be what you’d actually pay, we recommend recalculating the net price. To do this, subtract the costs you would incur from the aid you would accept. Make note of these new net prices if they differ from the original calculations.

A Very Important Note:

If you are going to make any alterations to reflect what you’d actually pay, make sure to verify those costs before using them in your calculations. One example of this is housing. If the COA uses on-campus housing in its calculation but you plan to live off campus, don’t use one flat housing estimate across the board for all institutions.

For example, rent might cost $600/month in a small, rural town in Connecticut, but it likely won’t cost that in downtown Boston. Always call the university and ask for an estimate of what the average student spends on something before making your own estimates.

How to Compare Aid Offers

Now that you’ve calculated the net price of each institution, it’s time to take all the information you have and compare aid offers. We recommend the following steps:

- Create a spreadsheet with a column for each school.

- Record the following information for each school:

- The COA

- The free aid you won’t have to pay back (scholarships, grants, etc.)

- The aid you would have to pay back (loans)

- The cost to attend after subtracting the free aid

This will give you an idea of the overall cost to attend each school, how much free aid you’ve been awarded at each, and how much you would potentially have to take out in loans for each school.

Is My Financial Aid Offer Good?

Most institutions don’t meet 100% of the student’s financial need. Additionally, most institutions will have loans somewhere in their aid package. So, if your award letter only covers a portion of your need and part of that aid is through loans, your offer isn’t far off from the norm.

A few facts and figures to keep in mind:

- On average, institutions meet 86% of student financial need.

- The average need-based grant is $28,448.

- The average aid package is $29,916 for a school where tuition and room and board total to $40,580.

You may also be able to find information about the average aid awarded at each specific institution via their website. This information can be helpful in seeing how your aid offer compares to their average. Ultimately, you’ll want to ask yourself what makes sense for you individually.

How and When to Appeal a Financial Aid Award

When comparing offers, you may notice that one institution offered significantly more aid than another. This is common and can happen for a variety of reasons.

While it may seem like a solid idea to negotiate the aid offered, experts don’t recommend pitting one institution against another. The only time you should do this is if you’re positive the institution will consider appeals where financial situations haven’t changed.

More often than not, institutions will only accept appeals on aid where a financial situation has changed since the FAFSA was submitted. For example, divorce of parents, death, unexpected medical expenses, and natural disasters are all circumstances that would warrant an appeal of a financial aid offer.

You can typically submit an appeal through the school’s financial aid office website. If you do, be prepared to provide additional information. Some institutions may ask for a detailed outline of your typical expenses, a written statement, or to see the other aid letters you received from other universities.

Accept Aid Intentionally

When you decide to accept aid, always accept it in the following order:

Scholarships/Grants (free money) → Work Study (earned money) → Loans (borrowed money)

Scholarships and grants don’t need to be repaid, so you’ll want to accept those first. (who doesn’t love free money?!) If offered work-study, it’s a good idea to accept that second. While it doesn’t guarantee you a job, work-study would provide you with the opportunity to have a part-time job on campus to help fund your education. Always accept loans last as they need to be repaid and will accrue interest over time, meaning you’ll pay more than what you’re borrowing.

Other Important Notes

Don’t guess on anything. Before accepting any financial responsibility of this scale, it’s important to understand what you’re agreeing to.

Financial aid award letters might have abbreviations or language you’re unfamiliar with. Always contact the institution’s financial aid office to ask what this means if you’re confused.

Final Thoughts

This phase of the college application and acceptance process can certainly be overwhelming. However, it’s one of the most important parts of the process. Understanding the financial responsibility you are about to take on is important, so make sure you take your time deciphering your financial aid award letters before committing to any one institution.

If your financial aid package doesn’t cover your total cost of attendance, it may be time to look into private student loans. When the time comes, we’ve got you covered. Fill out the free Sparrow application to see what private student lenders you qualify with.

Leave a Reply