During his 2020 presidential campaign, President Joe Biden emphasized time and time again his plan to cancel student debt. This has sparked a conversation about what this really means and whether or not we should actually do it.

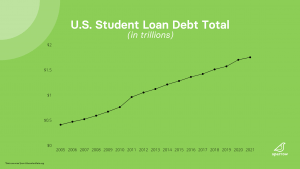

If you happen to be one of the 43 million Americans whose student debt is part of the national total of $1.7 trillion, this may sound like music to your ears. However, there are pros and cons to canceling student debt that are important to consider.

*Article as of December 2022. For updated information on President Biden’s student debt cancelation actions, please visit the rest of our blog.

What Does Student Debt Cancellation Really Mean?

What Does Student Debt Cancellation Really Mean?

Canceling federal student loan debt would relieve borrowers of the obligation to pay back federal student loans.

Biden’s Proposed Plan

Biden’s presidential campaign focused largely on changes in higher education and student debt.

His plan included:

- Immediate Cancellation of Some Student Loans

- Specific Areas of Forgiveness

- Free Tuition

- Increased Support for Public Servants

- Larger Pell Grants

- Income-driven Repayment

“Immediate” Cancellation

Biden has supported the immediate cancellation of $10,000 of federal student loan debt per person as part of COVID-19 relief.

Democrats and progressives alike have been advocating for student borrowers and asked Biden to cancel $50,000 of federal student debt per borrower instead of his planned $10,000. While ambitious, politicians such as Senator Chuck Schumer and Senator Elizabeth Warren believe it is possible and warranted.

However, Biden previously stated that he doesn’t believe he has the authority to cancel such large sums of student loan debt. In some interviews, Biden even suggested that he disagrees with canceling such large amounts.

However, in August 2022, Biden announced a plan to cancel up to $20,000 in student loan debt per borrower. Due to litigation surrounding the action however, it is currently on hold.

Specific Areas of Forgiveness

In Biden’s federal student debt plan, he proposed forgiveness in the following ways:

- For those who earn less than $125,000/year.

- For undergraduate student loans. Graduate students’ debt would not be canceled under Biden’s proposed plan.

- For those at public colleges and universities, as well as private HBCUs and minority-serving institutions.

People with private student loans would not be impacted or relieved of their debt under this plan.

Free Tuition

In Biden’s American Families Plan, he proposed making college tuition-free for some schools such as:

- Community colleges

- Minority-serving institutions such as HBCUs

It’s important to note that this plan covers tuition and tuition only, meaning you would still have to pay the additional costs like room and board, meal plan, and fees.

Increased Support for Public Servants

Biden plans to provide more student debt support to people pursuing public service by:

- Forgiving up to $50,000 and immediately canceling $10,000 for each year someone completes an eligible form of public service. People in this category would be eligible for 5 years of this loan forgiveness.

- Making changes to the current Public Service Loan Forgiveness Program (PSLF). His changes would allow more loans to qualify for forgiveness and for specific amounts of forgiveness after 5 years of public service. Biden’s additions would not replace the current PSLF program.

Larger Pell Grants

The Pell Grant is a form of need-based federal financial aid that typically does not have to be repaid. It is meant to help eligible low-income students pay for college costs, including tuition, fees, room and board, and other educational expenses. As of 2021, the maximum Pell Grant is $6,495 and the minimum is $650.

In Biden’s 2022 budget, he requested to increase the maximum amount for Pell Grants by $400.

Income-Driven Repayment

In his campaign, Biden proposed a new income-driven repayment plan for federal student loans. It includes:

- Undergraduate loans only. Graduate student loans would not qualify for this repayment option.

- Automatic enrollment. Everyone would be automatically enrolled in this plan and would need to opt-out on their own if they didn’t want to participate.

- Untaxed forgiveness. Current loan forgiveness programs typically tax the amount you are forgiven. Under Biden’s plan, the amount owed in student loan debt would be forgiven tax-free after 20 years.

- $0 monthly payments. If you make less than $25,000 per year, your monthly payments would be $0 under Biden’s proposed plan.

What Does This Mean for People with Private Student Loans?

Biden does not have the authority to cancel private loans. His plans focus on federal student loans, as they are owned by the government.

Private lenders provide money to borrowers on their own terms separate from the government. If you have private loans and student debt forgiveness does happen, your private student loans will remain as is.

The Pros and the Cons

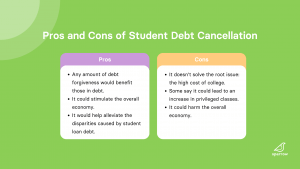

In no way is this an exhaustive list of the pros and cons of canceling student debt, but these are the main arguments for and against it:

The Pros

- Any amount of student loan forgiveness would benefit those in debt.

- It could stimulate the overall economy. If borrowers were able to divert some of their money from making student loan payments to things like buying a house, it could lead to overall economic growth.

- It could help alleviate some of the disparities caused by student loan debt. There are racial and ethnic disparities within the student debt crisis, and canceling even some student loan debt could help even the playing field.

The Cons

- Student debt cancellation does nothing to address the root of the problem: the high cost of a college education in today’s world.

- Some say it could lead to an incredibly privileged class of recent college graduates.

Final Thoughts

The answer to whether or not we should cancel student debt really comes down to how you personally weigh the pros and cons in your mind. What we do know is that there has been a lot of talk surrounding the topic and many politicians and companies are stepping forward in support of student debt cancellation.

Leave a Reply