“Can I get a student loan even though I have bad credit?”

The simple answer: yes. The more complicated answer: welllll, yes, but it’s going to be trickier.

While most federal student loans don’t require you to have a good credit score, or any credit at all, most private student loans, on the other hand, do. If you’re worried about your poor credit score preventing you from being able to pay for college, don’t fret. While it may be more difficult, it isn’t entirely impossible.

Here’s what you can do to get a student loan with bad credit.

>> MORE: Compare student loan rates from 17+ lenders

What is Considered Bad Credit?

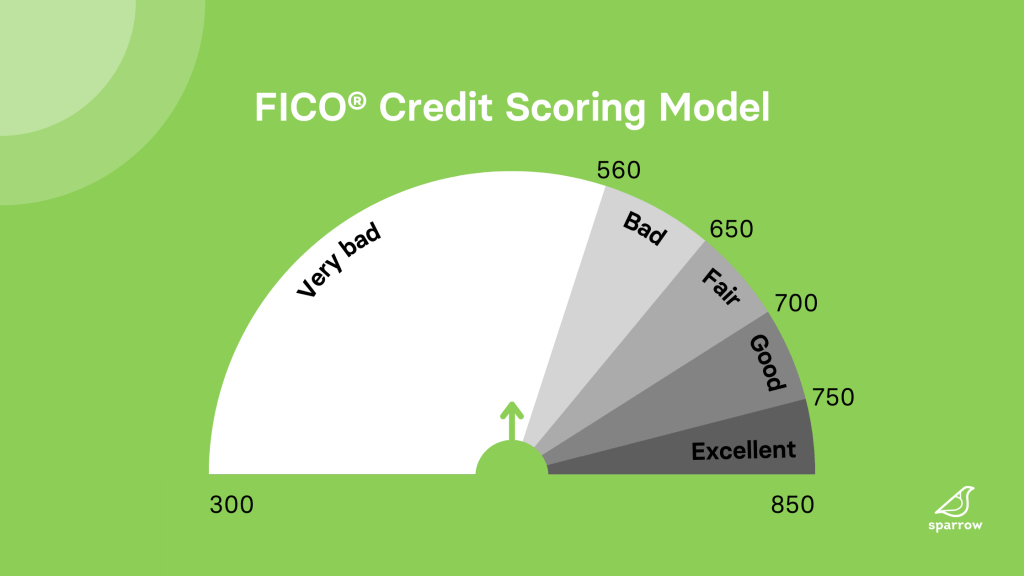

Generally speaking, you will need a credit score of at least 670 or higher to qualify with most private lenders. That said, what each individual lender considers “bad” credit will vary. And, there are several lenders that work with borrowers with lower credit scores.

It’s important to note that most private lenders use the FICO credit scoring model. The FICO scale uses a range of 300-850 to measure creditworthiness, so the closer you are to 850 the better.

>> MORE: What credit score is needed for a student loan?

Can You Get a Student Loan with Bad Credit?

Yes. Regardless of which student loan type you choose, whether federal or private, there are options for borrowers with bad credit.

>> MORE: How to remove student loans from your credit report

Best Private Student Loans for Bad Credit

First, here’s is a list of the top 5 student loans for bad credit. Rather than searching for lenders one-by-one, we recommend starting the process with an automated student loan search tool. After you complete the free Sparrow application, we’ll show you the rates and terms you’d qualify for with 17+ premier lenders.

The latest rates from Sparrow’s partners

See a rate you like? Click Apply and we’ll take you to the right place to get started with the lender of your choosing.

Find my rate

Arkansas Student Loan Authority

The Arkansas Student Loan Authority (ASLA) is an Arkansas state entity that provides educational funding for all Arkansas students who wish to attend higher education institutions. ASLA has a minimum credit score requirement of 670. ASLA is a great option for Arkansas students.

Ascent is an online lender that offers educational funding for students. They offer three types of student loans: a traditional cosigned loan, a non-cosigned credit-based loan, and a non-cosigned outcomes-based loan. Collectively, the three options provide a great selection for those who do not have a cosigner available, are international or DACA students, or have lower credit scores. Ascent’s minimum credit requirement varies based on the loan.

Brazos is a non-profit lender offering educational funding through private student loans available only to Texas Residents. They offer a wide range of loan options, covering undergraduate, graduate, MBA, law, medical, dental, veterinary, and doctoral degree programs. Brazos does not disclose their minimum credit requirement. Brazos is a great option if you live in Texas and want competitive interest rates.

College Ave Student Loans offers educational funding for undergraduate, graduate, professional, and career school students, and parents of students. To qualify for a student loan with College Ave, you will need a credit score in the mid-600s. College Ave is a great option if you are seeking a more flexible repayment term that allows you to find a loan that matches your budget.

Earnest’s student loans provide funding to undergraduate, graduate, and professional students. Earnest has a minimum credit score requirement of 650. They’re a great option if you are seeking competitive interest rates, unique borrower perks, and flexible repayment options that allow you to find a loan that matches your budget.

Edly Income-Based Repayment (IBR) Student Loans, originated by Edly’s partner FinWise Bank, provide an alternative loan option for students. Students who are approved for an Edly student loan will not have to make payments while in school. Instead, borrowers make payments after graduation based on their income. Due to the structure of IBR loans, borrowers have a variety of benefits when it comes to repayment. An Edly IBR loan is best if you are seeking a loan option with no cosigner, competitive repayment terms, and flexible repayment options.

Funding U is an online lender that focuses exclusively on undergraduate students with no cosigner. Rather than looking at your credit score or income, Funding U looks at non-traditional metrics such as your school, major, GPA and estimated future earnings to assess your creditworthiness. Funding U’s student loan is best if you are a high-achieving undergraduate student with limited credit history and no access to a creditworthy cosigner.

LendKey is an institution that offers educational funding to undergraduate and graduate students. By connecting borrowers with a network of 100+ lesser-known credit unions and community banks, LendKey allows you to work with smaller lenders with low rates and good customer service, rather than traditional lending institutions. LendKey has a minimum credit requirement of 660. It’s best for students who want generous cosigner release and forbearance policies.

MPOWER is an online lender that offers educational funding to international, domestic, and DACA students. They offer non-cosigned undergraduate and graduate student loans. It is best for international students and DACA students who don’t have a credit history and can’t access a qualified cosigner.

Can You Get Federal Student Loans with Bad Credit?

Most federal student loans don’t require you to have a good credit score (or any credit at all). They also tend to have lower interest rates and better terms and conditions. These qualities make them a great place to start when thinking about financing your college education.

There are four main types of federal student loans, three of which do not require a credit check or a high credit score to qualify.

Federal Loans that Don’t Require a Credit Check

Direct Subsidized Loans

Direct Subsidized Loans are available only to undergraduate students who demonstrate financial need. This means that you may not qualify for Direct Subsidized Loans.

If you do, the government will pay the interest on your Direct Subsidized Loans while you are in school. Once you graduate, you’ll be in charge of paying them back, interest included.

Direct Unsubsidized Loans

Direct Unsubsidized Loans are available to both undergraduate and graduate students, and you do not need to prove financial need to qualify. However, while in school, the government does not pay interest on these loans. So, while you’re hitting the books, interest will be accumulating in the meantime.

Direct Consolidation Loans

Direct Consolidation Loans allow you to combine more than one federal loan into one. So, if you have several federal loans and want to simplify your payments, you can combine them into one singular loan, and thus, one singular payment. When you consolidate, your new interest rate is the average of your previous loans’ interest rates.

Federal Loans That Do Require a Credit Check

Direct PLUS Loans

Direct PLUS Loans are available to graduate/professional students and parents of students. Like Unsubsidized Loans, you will be responsible for any interest that accrues, even while in school. However, unlike all other federal loan types, Direct PLUS Loans do require an adverse credit check.

While the credit check process could be a bummer if you have bad credit, there is hope if you don’t pass it. Adding a creditworthy endorser to the loan may allow you to qualify.

How to Get Federal Loans with Bad Credit

In order to get federal aid, you need to fill out the Free Application for Federal Student Aid (FAFSA). This form will ask you to provide information regarding you and your family’s financial situation to determine your eligibility for aid, but it will not run a credit check as part of that evaluation.

>> MORE: Most common FAFSA application errors to avoid

It’s important to note that you don’t have to accept all the federal aid that you qualify for. You should always consider the terms and conditions and think about what makes most sense for you and your educational journey.

While federal loans do tend to be a better choice in comparison to private student loans, they won’t always be best. There’s a variety of different financial aid options for students, so make sure you understand what they all are and what they all mean before agreeing to one.

>> MORE: What are 4 types of financial aid for college?

Refinancing Student Loans with Bad Credit

The goal of student loan refinancing is typically to score a lower interest rate or monthly payment, saving you money in the long run. If you have a bad credit score, it may be challenging to secure a lower rate than what you currently have.

>> MORE: Compare student loan refinance rates from 17+ lenders

Before refinancing, ask yourself the following questions:

- Has your credit score improved since you took out the loan you currently have?

- Are you paying a high interest rate on your current loan? Do you believe you could secure a lower interest rate based on the market?

If you answered yes to either of these questions, then refinancing may be a good option for you.

>> MORE: Should I refinance my student loans?

Best Refinance Loans for Bad Credit

Here is a list of the top refinance loan companies for bad credit. In just three minutes, you can compare real and personalized student loan refinancing rates from 17+ lenders – for free – by using the Sparrow application.

The latest rates from Sparrow’s partners

See a rate you like? Click Apply and we’ll take you to the right place to get started with the lender of your choosing.

Find my rate

Arkansas Student Loan Authority

The Arkansas Student Loan Authority (ASLA) is an Arkansas state entity that provides student loan refinancing for Arkansas residents. ASLA has a minimum credit score requirement of 670.

College Ave offers student loan refinancing with competitive rates, flexible repayment terms, and strong customer service. Their student loan refinance offering is best if you are seeking a more flexible repayment term that allows you to find a loan that matches your budget. To qualify for a refinance loan with College Ave, you will need a credit score in the mid-600s.

LendKey is an institution that offers educational funding to undergraduate and graduate students. By connecting borrowers with a network of 100+ lesser-known credit unions and community banks, LendKey allows you to work with smaller lenders with low rates and good customer service, rather than traditional lending institutions. LendKey has a minimum credit requirement of 660. It’s best for students who want generous cosigner release and forbearance policies.

Earnest’s student loans provide funding to undergraduate, graduate, and professional students. Earnest has a minimum credit score requirement of 650. They’re a great option if you are seeking competitive interest rates, unique borrower perks, and flexible repayment options that allow you to find a loan that matches your budget.

ISL is a nonprofit lender that offers both private student loans and student loan refinancing. ISL’s student loan refinancing is best if you haven’t graduated and want generous forbearance policies. ISL has a minimum credit score of 670.

SoFi is one of the largest student loan refinance companies in the industry. With competitive interest rates, a diverse set of repayment options, and exclusive member benefits, SoFi is a good fit for borrowers with an associate’s degree or higher or borrowers with a high income. SoFi has a minimum credit score of 650.

What to Do if You Were Denied a Student Loan Due to Bad Credit

If you were initially denied a private student loan due to poor credit, your best bet is to look for a creditworthy cosigner. A cosigner is someone who agrees to sign onto the loan. In doing so, they agree that if the borrower fails to repay the loan, the cosigner will take responsibility for paying it back.

>> MORE: What is a private student loan cosigner?

Having a cosigner is valuable because their credit score will be factored into the lender’s decision to work with you, which can also help you secure a better interest rate and terms. So, if your credit score isn’t up to par but theirs is, you may be in luck.

Make sure you don’t pick just anyone to cosign unless you really, really have to. Make sure to find someone that is creditworthy and has a history of managing their finances effectively. Additionally, always make sure to have open conversations with whoever you choose before they agree to cosign. Explain the pros and cons of being a cosigner and what impact it could have for them. Discussing expectations around repaying the loan is also important so your cosigner knows what to expect.

>> MORE: Can you get an international student loan without a cosigner?

Tips for Improving Your Credit

Improving your credit score won’t happen overnight, but it is worthwhile to take any steps you can throughout the loan process to boost your credit.

Here’s a few tips to help get your credit score in check.

Stay Aware of How Much Debt You’re Taking On

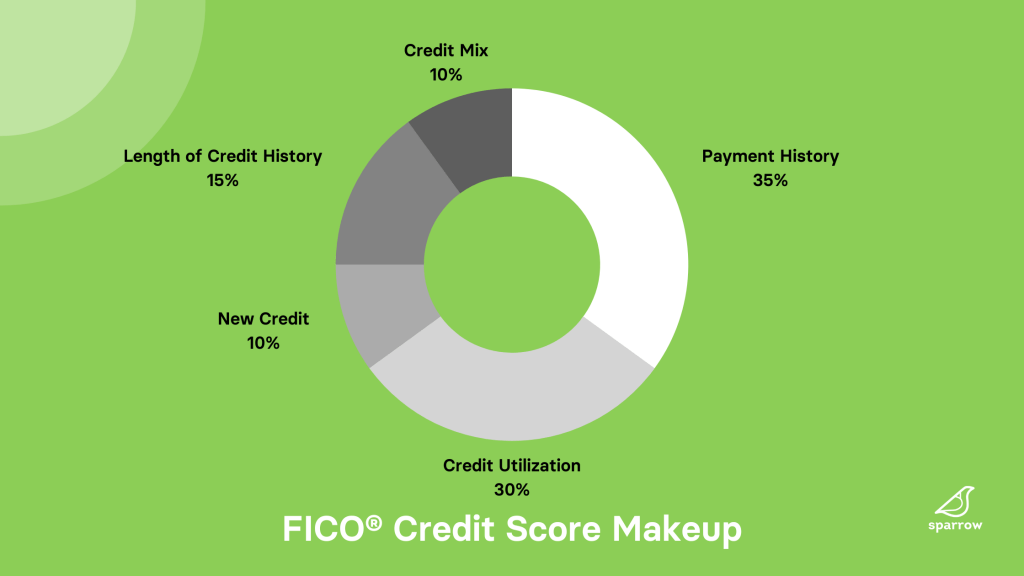

Your credit score is calculated based on a variety of factors, one being your payment history. In fact, your payment history is the most important part of your credit score, making up 35% of the calculation.

When you take on debt, such as student loans, you are doing so with the understanding that that money will be paid back and paid on time. If you make consistent, on-time payments, it’s good for your credit, as it demonstrates an ability to pay back debts successfully. If you pay late or miss payments, it could hurt your credit, as it demonstrates an inability to pay back debts successfully.

>> MORE: Most effective debt-payoff strategy

While this may sound like a no-brainer, you’ll want to be aware of how much debt you’re taking on. If you take on too much, it could make you more likely to miss a payment or go into loan default.

Remember to be realistic about how much you will be able to afford in monthly payments. Utilizing a student loan calculator to estimate your monthly loan payments after graduation is a great way to get real about whether the loan will be feasible when repayment starts. Let’s use an example here.

Let’s say you’re studying to be a public school teacher, and you land a job making $50,000 a year after graduation. This would land you around $4,200 per month (if we round up) to budget with. (For the ease of this example, we aren’t factoring in taxes.)

Now, let’s say your monthly expenses are as follows:

Rent: $1,300

Utilities: $200

Gas: $200

Health Insurance: $100

Dining Out: $200

Groceries: $250

You’re left with $1,950 each month. This example is simple and doesn’t factor in taxes or other expenses such as savings, car maintenance, pet costs, entertainment, and more.

If you’re debating a $30,000 student loan at a 9% interest rate and a 15-year repayment term, you’d be looking at a $304 minimum monthly payment. Now remember, this is for one loan. If you took out four of these loans, one for each year you’re in school, you’re looking at an even heftier monthly payment.

So, before taking out a student loan, consider whether the estimated monthly payments would be affordable for you given your future income potential. Being realistic about what you may be able to afford could prevent you from missing a payment down the line.

>> MORE: What credit score is needed for a student loan?

Keep Open Lines of Credit You Already Have

The length of your credit history is another important factor in determining your credit score. The longer you have had open lines of credit, the better your credit score will typically be. Having, and properly managing, your credit for a long time shows lenders that you’re responsible.

While it may sound counterintuitive, closing any open lines of credit you currently have could hurt your credit score because it shortens the length of your credit history. Unless you absolutely need to, stay away from closing any current accounts.

Don’t Open New Lines of Credit

Opening new lines of credit will cause what’s called a hard inquiry. A hard inquiry occurs when a financial institution checks your credit report before making a lending decision. When lenders do a hard inquiry, they’re attempting to assess how you’ve handled your credit in the past.

Just like you’d only lend money to someone you trust, lenders want to make sure you’re a sound investment for them before dishing out the cash. A hard inquiry, though, can temporarily hurt your credit. So, if you’re looking to take out a student loan anytime soon, we recommend holding off on opening any new lines of credit.

Check Your Credit Report

If you have bad credit but aren’t totally sure why, you may want to check your credit report. Your credit report is important to look over for many reasons, but especially to check for errors, fraud, or identity theft. Even a small error on your credit report can significantly hurt your credit score, so we recommend checking fairly often.

There are many financial institutions, such as banks and credit card companies, that offer free credit reports. If yours don’t, utilize the free Annual Credit Report website. You are, by law, entitled to these reports yearly.

Final Thoughts from the Nest

So, yes. You can get a student loan with bad credit. However, it might make the process a bit more challenging. Start thinking ahead about where your credit is at, and if it’s not ideal, start taking small steps to build it. To find a private student loan for students with bad/no credit, complete the Sparrow application today.

Sparrow’s goal is to give you the tools and confidence you need to improve your finances. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

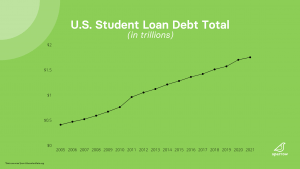

What Does Student Debt Cancellation Really Mean?

What Does Student Debt Cancellation Really Mean?