Figuring out student loans is overwhelming. People start throwing out loan lingo left and right, and all the terms start to blend together. The term “cosigner” is one popular example of this loan lingo and often becomes a point of confusion. Understanding what a student loan cosigner is and when you may want to have one is crucial in the student loan process. Let’s break it down.

What is a Cosigner?

A cosigner is someone who agrees to sign onto a loan alongside you, the borrower. By doing so, the cosigner takes legal responsibility for repaying the loan if you do not. A cosigner is often a family member or friend but can be anyone who is willing to cosign.

What Types of Loans Need a Cosigner?

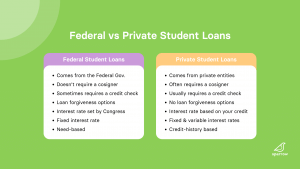

When paying for college, you will encounter two types of student loans: federal and private.

Federal student loans are provided by the government and do not require a cosigner.

Private student loans, on the other hand, come from private entities and are given out based on your creditworthiness.* If the lender deems you not creditworthy enough to borrow from them, you may need a cosigner to secure the loan.

Here’s is a list of some of the best student loans.

The latest rates from Sparrow’s partners

See a rate you like? Click Apply and we’ll take you to the right place to get started with the lender of your choosing.

Find my rate

*Creditworthiness is essentially how much a lender trusts you to pay back your debts. The higher your credit score, the more creditworthy you appear to lenders.

Why Would I Need a Cosigner?

There are a variety of reasons why you may need a cosigner to get approved for a private student loan, such as:

- Your credit score or income is too low

- Your credit or employment history is too short

- Your credit report shows a variety of other debt or a checkered history in repaying it

- Your residency status requires applying with a citizen or permanent resident cosigner

From the lender’s perspective, having a creditworthy cosigner lessens the risk associated with lending to you. It assures them that there is a responsible individual able to pay the loan in full and on time.

In these instances, having someone cosign may be your only option for actually securing a loan with that specific lender. Even if you are deemed creditworthy enough to take out a loan on your own, having a creditworthy cosigner can help you qualify for and borrow loans with more attractive terms.

Is Having a Cosigner a Bad Thing?

Needing a cosigner isn’t necessarily a bad thing and is actually quite common. According to a study conducted by MeasureOne, in the 2019-2020 academic year, over 90% of undergraduate students needed a cosigner for at least one private loan they took out. Even if you don’t need a cosigner, including one on your application may have additional positive benefits.

Benefits of Having a Cosigner

If you are able to have a creditworthy cosigner on your private student loans, there are numerous benefits, such as:

- The ability to secure a loan. Without a cosigner, you may not be able to secure a loan on your own.

- Lower interest rates. If your cosigner has demonstrated creditworthiness, private lenders will likely give you a lower interest rate on your loans.

- Less expensive over time. Lower interest rates on your loans means lower payments, which means less money spent over time.

The person cosigning can also benefit from doing so. If the primary borrower demonstrates responsibility in making their loan payments, the cosigner’s credit score can go up, too.

Can You Get a Loan Without a Cosigner?

The short answer here is yes. However, more often than not, you will need a cosigner on a private student loan, particularly if you’re an undergraduate.

You should shop around for a lender that will offer you the best interest rates and terms, but you may find that many require a cosigner for first-time, inexperienced borrowers.

If you can get a loan without a cosigner and still get the same interest rate either way, it’s best to take the loan out without the cosigner. It’s better to build your own credit over time without the cosigner being legally responsible for your debt.

What to Look For in a Cosigner

If you’re unable to get approved without a cosigner, having anyone willing to cosign will be helpful. But, if you do have a choice, here are a few things to look for in a potential cosigner:

- Someone with stable income who could genuinely handle paying off your loan if you struggle to do so yourself

- Someone with little to no debt themselves as it could be challenging to support your loan payments (if needed) with their own debt

- Someone with a high credit score

- Someone with a solid debt repayment history

Final Thoughts from the Nest

Whether you need a cosigner may be a bit out of your control. The good news is that most college students need a cosigner and ultimately benefit from having one. Understanding what they are and how to proceed if you do need one is the most important first step.

If you’re struggling to find a cosigner, don’t worry. We’ve partnered with several lenders to offer Sparrow members non-credit-based student loans that don’t require a cosigner. To see what loan options you prequalify for, fill out the Sparrow application.

Leave a Reply