Throughout the course of your college education, you’ll probably take out many loans. And by the end of it, it may be hard to keep track of. Add in the fact that you have poor credit and not the best credit history, and it just seems too hard to manage. What can you do?

Well, you can consolidate. Here’s what you need to know about consolidating with bad credit.

What is a Student Loan Consolidation?

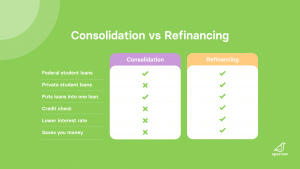

In the student loan space, the term “consolidation” refers to Direct Consolidation Loans. This is basically the process of combining some or all your federal student loans into one new loan. However, this is only available for federal student loans. It is not an option for private student loans. To do this same process with private student loans, you’d refinance them instead.

How Do You Qualify for a Direct Consolidation Loan?

To qualify for a Direct Consolidation Loan, your loans must be in repayment or in the grace period. To be in that part of your loan journey already, you must not be in school anymore. This can mean you’ve graduated, dropped out, or fallen below half-time enrollment.

Additionally, you can’t consolidate an existing consolidated loan. Unless you add another eligible loan, it’s not allowed. For example, say you’ve already gotten a Direct Consolidation Loan in the past. You couldn’t consolidate that same loan without adding a new loan to the mix.

What Credit Score Do You Need To Consolidate?

By now, I’m sure you know how important credit scores are to loans in general. You generally need excellent credit to get the best terms, but achieving this can be hard for some people. Luckily, Direct Consolidation Loans don’t require you to have a high credit score. It is possible to get these with bad credit.

Consolidating Student Loans with Bad Credit

To combine more than one federal loan into one loan, you have two options: a Direct Consolidation Loan or Student Loan Refinancing.

Consider Direct Consolidation Loans

Consolidating your federal student loans is a good move because they’re pretty accessible. As mentioned, you don’t need a high credit score to get a Direct Consolidation Loan. The most important thing you need is eligible federal student loans. Your loans can even be in default and they are still eligible. You’ll also have access to flexible repayment plans like income-driven repayment.

To get started, go to the Direct Consolidation Loan application on the federal student aid website. You can either fill it out online or download, print, fill it out, and then mail the application. It’s important to note that until you get your official loan, you want to keep on making all your loan payments on time. The only exceptions would be if you have loans in deferment, forbearance, or a grace period.

Consider Refinancing with a Lender with Flexible Credit Score Requirements

If you don’t get approved for a Direct Consolidation Loan, you can refinance instead. To recap, refinancing is a process similar to consolidation that is offered through private lenders. Refinancing is available for both your federal and private student loans. However, refinancing typically has stricter criteria than consolidating loans. For example, most lenders require you to meet the minimum credit score, which is typically in the mid-600s. That said, you can find lenders with more flexible credit score requirements.

If you’d like to refinance, start with Sparrow. Sparrow partners with 15+ different lenders, many offering lower or more flexible credit score requirements. Submit the Sparrow application and see what rates you qualify for.

You can also find a creditworthy cosigner to help you qualify for refinancing. Even if you don’t need a cosigner to qualify, it’s still a good idea to explore your cosigner options. A good cosigner can get you better loan and repayment terms than you would get on your own.

Can You Be Denied Student Loan Consolidation?

You can be denied a student loan consolidation for different reasons, such as a low income, too much debt, or a low credit score.

A low income might signal to a lender that you don’t have enough money to cover a new loan. Too much debt signals the same thing and that you might not be able to handle debt. A low credit score could leave a lender thinking that you aren’t trustworthy when it comes to money, making you too risky to take on.

While you don’t need collateral to take out a loan, providing this type of security can help you qualify. Without it, you can be rejected.

Final Thoughts from the Nest

If you want to simplify your federal loan payments, consolidating can be a good option. Because you don’t need a high credit score and can consolidate defaulted loans, consolidation loans are accessible to many people. So, if you want to lift that weight off your chest from so many loan payments and only have one, consider consolidating.

Whether it’s consolidating or refinancing, Sparrow has got your back. Sign up with us and let us do our work so you can spend less time thinking about loans and more time on the important stuff.

Leave a Reply