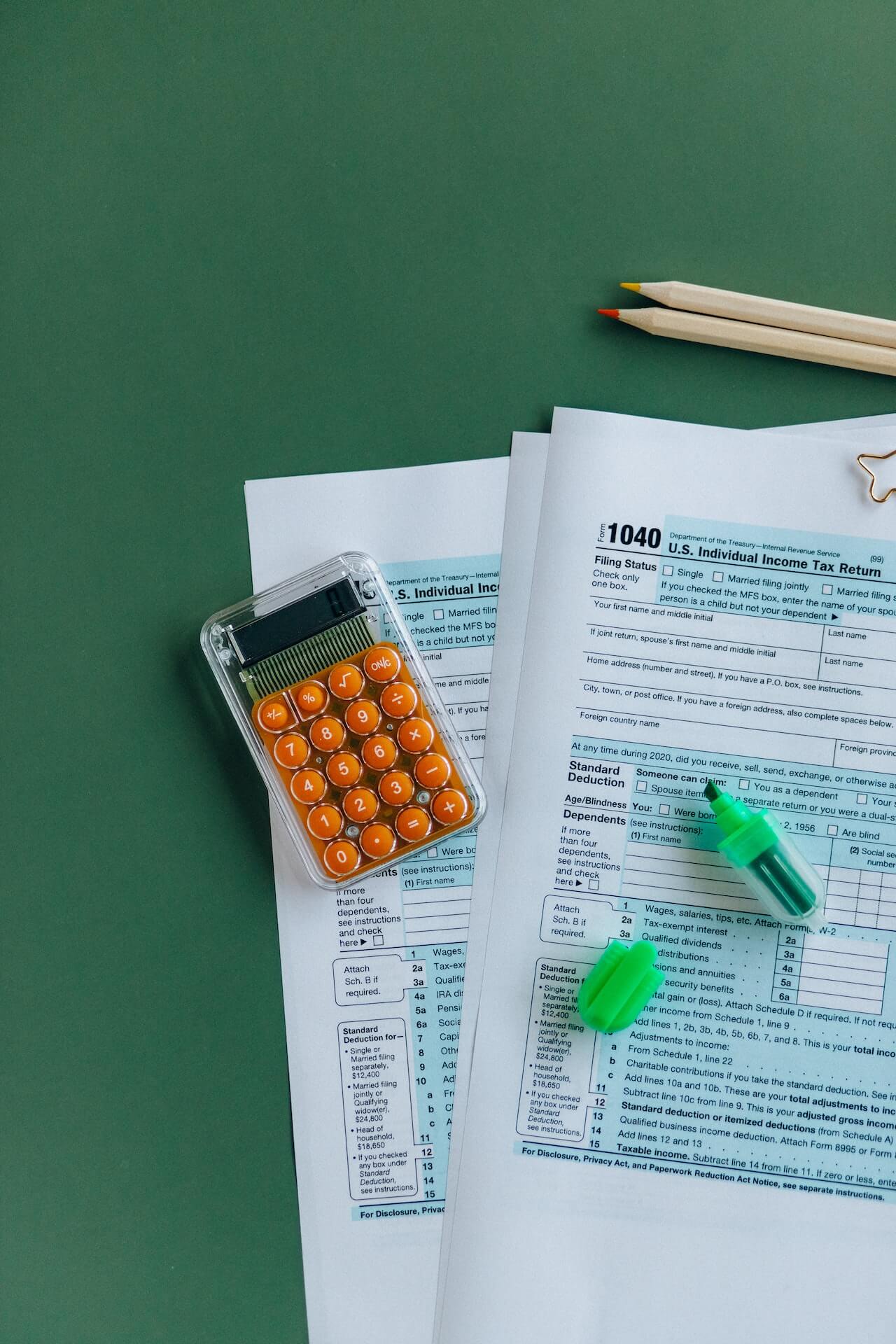

An important factor when shopping for student loans is looking at the interest rate. But interest rates can be a little confusing. You may ask yourself questions like: Before you panic, don’t worry. We’ve got your back. To give you an idea of what to look for in interest rates, let’s go over the average …

Continue reading “Average Student Loan Interest Rate in January 2025”